In the realm of accounting, all of the following are manufacturing costs except those items that fall outside the specific definition and scope of manufacturing expenses. Understanding these exceptions is crucial for accurate financial reporting and effective decision-making.

Manufacturing costs encompass expenses directly related to the production of goods, including raw materials, labor, and factory overhead. However, certain costs, despite their relevance to the business, are not considered manufacturing costs due to their indirect nature or their classification as non-production expenses.

Manufacturing Costs

Manufacturing costs are the costs incurred during the production of a product. They include the direct costs of materials, labor, and overhead.

The main categories of manufacturing costs are:

- Direct materials: These are the materials that are directly used in the production of a product.

- Direct labor: This is the labor that is directly involved in the production of a product.

- Manufacturing overhead: These are the indirect costs of production, such as rent, utilities, and depreciation.

It is important to track manufacturing costs because they are used to determine the cost of goods sold and the profitability of a company.

Exceptions to Manufacturing Costs

Exceptions to manufacturing costs are items that are not considered to be manufacturing costs. These items include:

- Selling and administrative expenses: These are the costs incurred in selling and marketing a product.

- Research and development costs: These are the costs incurred in developing new products.

- Interest expense: This is the cost of borrowing money.

These items are not considered to be manufacturing costs because they are not directly related to the production of a product.

Examples of Non-Manufacturing Costs: All Of The Following Are Manufacturing Costs Except

Some specific examples of non-manufacturing costs include:

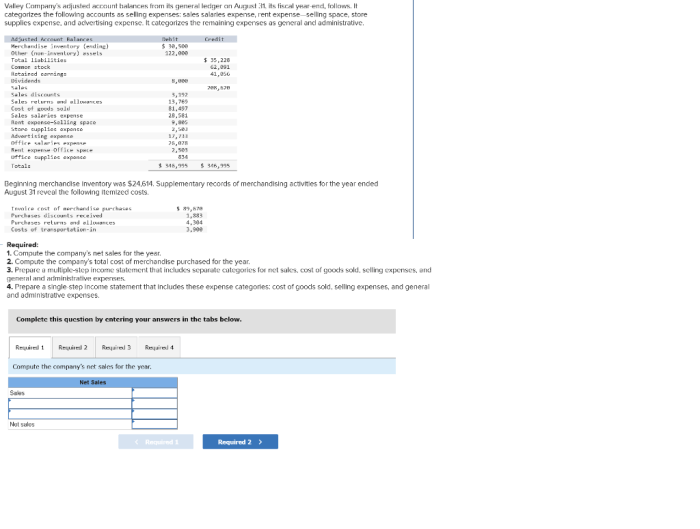

| Item | Category | Reason for Exclusion |

|---|---|---|

| Sales salaries | Selling and administrative expenses | Not directly related to production |

| Advertising expenses | Selling and administrative expenses | Not directly related to production |

| Research and development costs | Research and development costs | Not directly related to production |

| Interest expense | Interest expense | Not directly related to production |

Implications of Non-Manufacturing Costs

Excluding certain items from manufacturing costs has several implications. First, it affects the cost of goods sold. Non-manufacturing costs are not included in the cost of goods sold, so excluding them from manufacturing costs reduces the cost of goods sold and increases the gross profit.

Second, it affects the profitability of a company. Non-manufacturing costs are not included in the calculation of net income, so excluding them from manufacturing costs increases the net income and makes the company appear more profitable.

Finally, it can impact decision-making. By excluding certain items from manufacturing costs, companies can make it appear that their products are more profitable than they actually are. This can lead to poor decision-making, such as investing in new products that are not actually profitable.

Commonly Asked Questions

What is the significance of excluding certain items from manufacturing costs?

Excluding non-manufacturing costs allows for a more precise calculation of production expenses, providing a clearer understanding of the costs directly related to the production process.

How do non-manufacturing costs affect financial statements?

Non-manufacturing costs are typically reported in separate line items on the income statement, ensuring transparency and providing a comprehensive view of the company’s overall expenses.

Can non-manufacturing costs impact decision-making?

Yes, understanding non-manufacturing costs helps businesses assess their overall cost structure, optimize resource allocation, and make informed decisions regarding pricing and production strategies.