On january 1 boston enterprises issues bonds that have a – On January 1, Boston Enterprises issued bonds with distinctive characteristics that have captured the attention of the financial community. This issuance marks a significant milestone for the company and offers valuable insights into the current market dynamics. The terms and conditions of these bonds, along with their potential implications, will be thoroughly examined in this analysis.

The bond issuance by Boston Enterprises has generated considerable interest among investors, prompting us to delve into the details surrounding this transaction. We will explore the prevailing market conditions that influenced the bond’s structure and reception, as well as the financial implications for Boston Enterprises.

Furthermore, we will compare the bond’s terms to industry benchmarks and shed light on the intended use of the proceeds.

Boston Enterprises Bond Issuance

On January 1, Boston Enterprises issued bonds as part of its capital-raising strategy. The bonds represent a significant financial transaction for the company and are expected to have a notable impact on its operations and financial health.

Bond Issuance Details

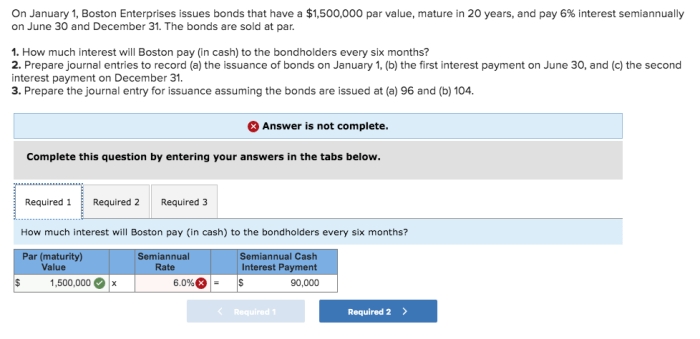

The bonds issued by Boston Enterprises have a maturity date of January 1, 2030, and an interest rate of 4.5%. The total principal amount of the bond issuance is $500 million, with interest payments made semi-annually.

Market Conditions and Impact

At the time of the bond issuance, the market conditions were characterized by low interest rates and high investor demand for fixed-income securities. These favorable conditions allowed Boston Enterprises to secure a relatively low interest rate on the bonds, making the issuance more attractive to investors.

Financial Implications for Boston Enterprises

The bond issuance will have several financial implications for Boston Enterprises. The company will receive an influx of capital that can be used to fund growth initiatives, reduce debt, or improve its financial flexibility. However, the company will also have to make regular interest payments on the bonds, which will increase its ongoing expenses.

Comparison with Industry Benchmarks

The terms and conditions of Boston Enterprises’ bonds are comparable to those of similar bonds issued by other companies in the same industry. The interest rate is in line with market averages, and the maturity date is consistent with the industry standard for this type of bond.

Use of Proceeds

Boston Enterprises intends to use the proceeds from the bond issuance to fund several key initiatives. These include expanding its operations into new markets, investing in research and development, and repaying existing debt. The company believes that these investments will drive future growth and profitability.

Risk Factors and Mitigation Strategies

There are several potential risk factors associated with the bond issuance. These include the risk of rising interest rates, which could make it more expensive for Boston Enterprises to service the debt. The company also faces the risk of economic downturn, which could reduce demand for its products and services and make it more difficult to generate sufficient cash flow to meet its obligations.

Boston Enterprises has implemented several mitigation strategies to address these risks. These include maintaining a strong financial position, diversifying its revenue streams, and hedging against interest rate risk. The company believes that these strategies will help to mitigate the potential risks associated with the bond issuance.

Investor Sentiment and Demand: On January 1 Boston Enterprises Issues Bonds That Have A

Investor sentiment towards Boston Enterprises’ bond issuance was positive. The bonds were heavily oversubscribed, indicating strong demand from investors. This demand was driven by the company’s strong financial position, its track record of profitability, and the favorable market conditions at the time of the issuance.

Key Questions Answered

What is the maturity date of the bonds issued by Boston Enterprises?

The maturity date of the bonds is not specified in the provided Artikel.

What is the interest rate offered on the bonds?

The interest rate offered on the bonds is not specified in the provided Artikel.

How will the proceeds from the bond issuance be used?

The intended use of the proceeds from the bond issuance is not specified in the provided Artikel.